Decentralized finance defi is swiftly transforming the financial landscape by leveraging the power of blockchain technology. This revolutionary method disrupts traditional institutions, empowering individuals with improved control over their funds. Smart contracts execute transactions, eliminating the need for intermediaries and offering visibility throughout the process. With its potential to equalize access to financial products, DeFi is poised to transform the way we interact with money.

- Key benefits of DeFi include:

- Openness: Transactions are recorded on a public blockchain, improving trust and accountability.

- Accessibility: Anyone with an internet connection can participate in DeFi applications.

- Optimized Operations: Smart contracts automate tasks, lowering costs and timeframes.

Harnessing AI for Intelligent Investment Strategies

The financial landscape is here rapidly evolving, driven by the growth of artificial intelligence (AI). Discerning investors are turning to AI-powered tools to gain a competitive edge. These innovative technologies leverage deep learning to process vast datasets, identifying trends that may elsewise remain hidden from human insight. By optimizing investment decisions, AI can augment portfolio yield and reduce risk.

Digital Assets: A New Frontier for Portfolio Diversification

As traditional markets navigate an increasingly volatile landscape, investors are actively seeking novel approaches to enhance portfolio stability. copyright assets have emerged as a compelling alternative, offering the potential for substantial profitability while potentially reducing risk exposure. This burgeoning asset class presents unique characteristics that can augment existing portfolios, providing investors with a new layer of diversification.

- Furthermore, the decentralized and transparent nature of blockchain technology underpinning copyright assets adds a layer of trust that can attract investors seeking greater accountability in their investments.

- Despite, it is crucial for investors to approach copyright assets with a prudent mindset. The market remains highly dynamic, and thorough research is essential before allocating capital.

As the copyright asset landscape continues to evolve, its potential for portfolio enhancement remains a subject of intense scrutiny. While risks exist, the allure of potentially unlocking new avenues drives continued interest from both institutional and individual investors.

A Blockchain's Transformative Impact on Financial Institutions

Financial establishments are embracing blockchain technology at an rapid pace, recognizing its capacity to revolutionize workflows. Blockchain offers transparency, strengthening trust and safety in financial movements. Smart contracts, a central component of blockchain, can automate complex arrangements, reducing costs and boosting efficiency. Additionally, decentralized finance (DeFi) applications built on blockchain are disrupting traditional banking services, providing options for lending, borrowing, and investing.

Understanding Digital Assets: A Comprehensive Guide

Digital assets represent a evolving landscape within the financial structure. From cryptocurrencies, to unique digital assets, understanding these principles is vital for businesses in today's virtualized world. This overview aims to demystify the fundamentals of digital assets, providing knowledge into their properties, opportunities, and applications.

- Explore the diverse classifications of digital assets, ranging from centralized tokens to unique digital collectibles.

- Investigate the core technologies that power digital assets, including blockchain and its revolutionary influence.

- Understand the potential downsides associated with digital asset trading, and learn about strategies to mitigate these issues.

Whether you are a seasoned investor or just starting your discovery into the world of digital assets, this comprehensive guide will empower you with the insights needed to thrive in this transformative sphere.

Finance's Evolution: copyright, Blockchain, and AI Intertwined

The financial landscape is undergoing/is experiencing/will be transforming a paradigm shift as cutting-edge technologies like copyright/digital assets/virtual currencies, blockchain/distributed ledger technology/chain technology, and artificial intelligence/machine learning/deep learning converge. This convergence/intersection/fusion has the potential to revolutionize every facet/various aspects/all dimensions of finance, from transaction processing/payment systems/financial operations to investment management/portfolio optimization/risk assessment.

copyright, with its decentralized/disruptive/innovative nature, is poised to challenge/disrupt/transform traditional financial intermediaries. Blockchain technology provides a secure/transparent/immutable platform for recording and verifying transactions, while AI algorithms can analyze vast datasets/information/financial records to identify/predict/forecast market trends and optimize/personalize/tailor financial services. This synergy/combination/intersection of forces will lead to a more efficient/faster/smarter financial system that is accessible/inclusive/equitable to all.

Scott Baio Then & Now!

Scott Baio Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Talia Balsam Then & Now!

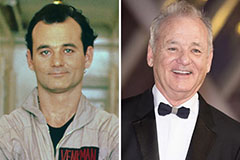

Talia Balsam Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!